The $500 Trillion Crypto

The total crypto market cap hit its all-time high on January 7th, 2018 reaching $830 Billion for a few hours before dropping to $430 Billion 10 days later. By the end of June, it collapsed to $235 Billion.

There are many pieces written about the cryptocurrency bubble and its similarity to the .com era.

Looking at the speed at which capital was flowing into this market, the number of undifferentiated coins and ICO scams, one could only wonder how could this last.

But is there more to the current crypto craze than the ”yet another bubble” narrative?

One of the thoughtful and balanced articles about this space is by Mark Suster: Want to Really Understand What all the Hype of Cryptocurrency is About?

1. Allowing for a decentralized Internet in which value is accrued to infrastructure, protocols and applications that serve market need

2. Allowing electronic trade across actors who may not know or trust each other without middlemen who take a heavy toll / tax on the transaction

3. Allowing for (the potential of) a more stable currency than one’s own government for citizens who may live under despotic or irresponsible regimes

Those are the most impactful initial use cases and will be achieved over time by the platforms, protocols, currency-like coins, and distributed apps that already started to emerge.

It’s worth reading the entire blog as it effectively articulates those three areas and the ways blockchain and decentralized systems could offer potential solutions.

I also previously wrote about how blockchain and smart contracts could improve online marketplaces by cutting “middleman entities” and bringing the value back to the trading parties.

There is, however, another use case that is much larger, in terms of allocated capital, than anything else.

In what follows, we will use the more generic terms “crypto assets” or “crypto” instead of cryptocurrencies as the current circulation is a mix of currencies, utility tokens, protocols, securities and, of course, kitties…

One of the common critics of crypto assets is that it’s an instrument for speculative trading.

Looking at why most people invest in crypto at the moment, it is more often about the potential gains from price increase than for the underlying utility. This is true even for protocols and apps built with a genuine need for a token to operate the system.

The money injected into blockchains to cover the cost for running smart contracts, decentralized apps and transactions is only a small fraction of the total crypto market cap. The most significant portion is a store of capital with the objective of selling at a higher price.

Crypto assets are indeed used massively as a speculative investment vehicle.

The puzzling part is why so many consider this a problem?

Let’s step away from the crypto world for a moment and take a look at the traditional stock exchanges.

The top 20 stock markets’ capitalization constitute over 90% of the global exchanges.

Their combined market cap is $77.7 Trillion with a monthly trading volume of $5.9 Trillion.

There are distinctions between stocks and cryptos and what market cap mean for each. “Cryptoeconomics is hard: Market Cap” is a good read addressing those differences.

However, what is similar is the motive behind why people invest in both the public stock market and the crypto assets. That motive is speculation. Whether it’s day trading or long-term investment, the objective is to make potential profits from the appreciation of the asset.

IPOs do provide initial utility. They offer a fundraising mechanism for companies, some liquidity for founders and employees as well as an exit for early investors. But beyond the IPO milestone, public stock ownership doesn’t give access to any utility offered by the underlying company. It is only held or sold for potential financial rewards.

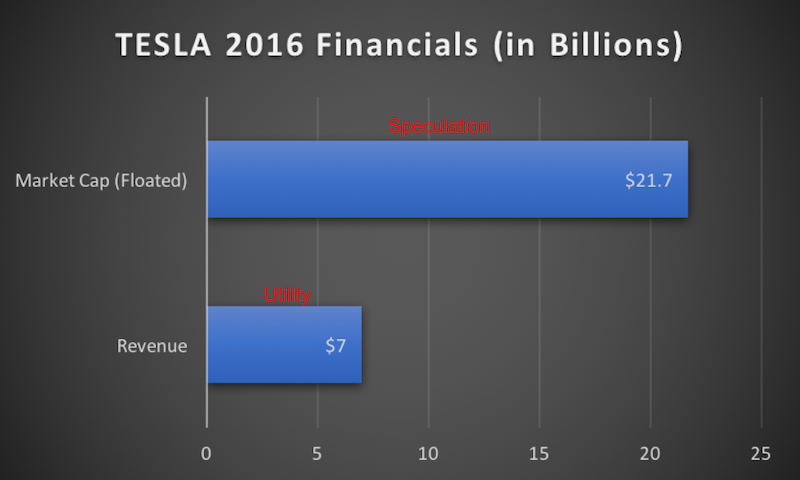

As an example, let’s consider Tesla, a company I highly admire.

It had revenue of $7B in 2016 and a market cap of $35B.

62% of its total shares outstanding are floated for trading on the public market, so the liquid part was worth around $21.7B at the time.

The money injected in Tesla for actual utility is the revenue from its product and services sales.

All the cash flowing in its public stock is purely for speculative trading. The stock can’t be exchanged for a car nor be used to access the superchargers.

In this case, the speculation capital is more than 3x the utility capital without accounting for options trading.

Some may argue “but a share is partial equity of a real company, a token doesn’t give any ownership.” That is true. The fact is, it doesn’t matter, and it doesn’t mean much in practical terms.

Even if you own $500,000 worth of Tesla stock, you can’t claim a partial office space nor a tiny piece of its factory. Chances are you won’t even be allowed in.

So are people really seeking ownership or just a speculative instrument that acts as a proxy to the appeal of the underlying asset?

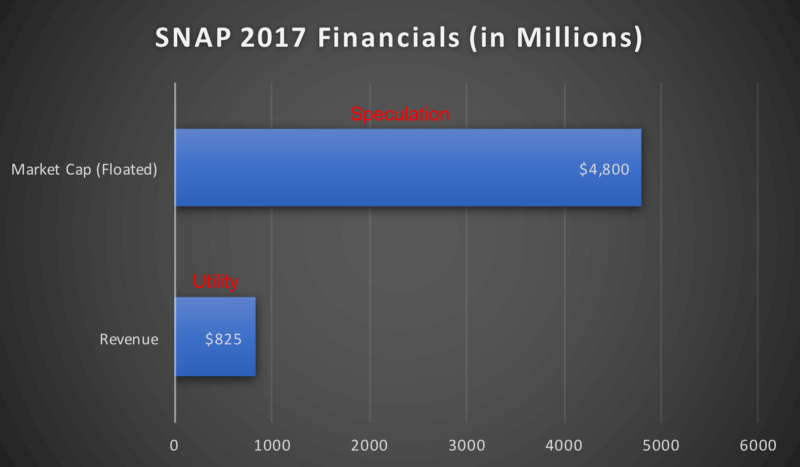

The same exercise could be done for Snap. In 2017, it had a revenue of about $825 Million and the year end market cap was at $14.6 Billion.

32.92% of its total shares outstanding are floated on the public market, so the liquid part was worth around $4.8 Billion.

Snap’s speculation capital is 5.8x the utility capital without accounting for derivatives such as options.

The critical point to highlight is that even if the cash injected for trading is worth multiples the money spent on product and services of those companies; it doesn’t diminish in any way their utility and impact. Even if Tesla’s stock speculation goes to the roof, its products won’t be any less world-changing.

If we agree that the public stock trading is mostly speculative, then the $430 Billion crypto market cap compared to the $77.7 Trillion from the world top exchanges shouldn’t be considered insane anymore, based solely on the monetary figure.

The crypto market is still problematic in many ways but the total amount of money injected is not one of them…

To put things further into perspective, let’s look at the exotic world of derivatives.

Derivatives don’t have intrinsic utility nor provide any direct ownership. According to Investopedia, on the high-end the the global market is estimated at over $1.2 Quadrillion!

Nevertheless, other analysts challenge that figure for being highly inflated.

A more reasonable estimation is the one done by BIS (Bank for International Settlements).

BIS estimates the global notional amounts outstanding for contracts in the derivatives market to be $542 Trillion

The reason the derivatives market is so large is because there are numerous derivatives available on virtually every possible type of investment asset, including equities, commodities, bonds and foreign currency exchange.

If we add Gold, which is estimated at $7.8 Trillion, to our cocktail, we get the following view:

Gold is used as a store of value, a speculative commodity and a utility. It is non-trivial to make a clear cut between each use case as they often overlap. For instance, in some cultures, gold jewelry is acquired both as a fashion accessory and a store of value.

At this stage, the capital flowing into crypto is more of a drop in the ocean than a big bubble.

If the amount of capital is not an issue, then what could possibly go wrong?

1. It could all go to zero

It is unlikely, as we may have passed escape velocity, but not impossible. This is more of an apocalyptic scenario where governments might ban the entire space, where all projects reach a dead end, or where some new quantum computing technology breaks the cryptographic security.

Decentralization and blockchain goal was to create independence from centrally trusted authorities, and it did to a certain extent. There is, however, still the need of gateways between the crypto and fiat worlds. That part can hardly escape government control.

2. ICO scams

Unfortunately, since 2017 we saw a rise in scams with fake projects and impersonation of known people in the space.

This can be solved by good online education and some level of regulation. There is often a negative connotation to the word “regulation” among crypto enthusiasts. I believe it only becomes a problem when states try to force old laws written a century ago into a space invented a few years ago.

If regulation is established on a fresh sheet with the true goal to protect consumers, it should be welcome. Assuming, it is not overly excessive with the sole intention to protect the interests of established financial institutions.

3. Zombie projects

There are two types of zombie projects. The first are legitimate ones that end up in this state because the idea failed, the same way as many non-blockchain startups don’t work out.

The problem is the second type which are zombie projects by design. They are not ICO scams as such but often a simple fork of some other coin. It results in non-differentiated blockchains because the teams had no intention to build a real business in the first place. How many “decentralized X” and “banking the unbanked” have we seen last year?

A few months down the road, the teams abandon the projects, and no code updates take place.

4. Pump and dump schemes

This is a very nasty one as it frequently takes place and affects both “sh!t coins” and legitimate projects.

Those schemes are illegal in regular stock exchanges, but as most crypto exchanges are still unregulated, it is challenging to prevent as of today.

5. Hacking

Many non-technical users find it challenging to manage their private keys securely. Some fall victim of hackers that trick them into sharing their wallet keys over a website and see their funds disappear in minutes.

Even established exchanges with professional network security teams suffered from hacking incidents.

New generation blockchains are trying to address the issue by implementing measures where, for example, beyond a certain amount, a smart contract will prevent the money from moving out of the wallet for a configurable amount of days. This would give time to owners to resolve the problem if they were not the issuer of the request.

In the early Internet days, it was easy to predict e-commerce but hard to foresee Twitter, AWS, and Netflix.

With the first smartphones and mobile broadband, video calls were obvious, but it was difficult to envision Uber, WeChat and Pokemon Go.

The world-changing blockchain and crypto applications are most likely those we can’t imagine at this stage.

So instead of obsessing over the speculative aspect, it would be best to rather focus on solving the problems stated above and open the way to what could be the next digital revolution.

Disclaimer: This is not an investment advice nor an endorsement of any particular asset class. It is simply a personal perspective about the landscape. Seek professional financial and legal advise before any investment decision.